| University | Singapore University of Social Science (SUSS) |

| Subject | Taxation |

Assignment Overview:

“All foreign incomes received in Singapore are not taxable”. Validate the above statement. Prepare an academic report (not exceeding 1,500 words) on tax implications of foreign income received in Singapore.

1. Provide an extensive discussion of S13(9) of Singapore Income Tax Act;

2. Explain the terms foreign-sourced income and exemptions available in Singapore;

3. Your explanation should include foreign-sourced branch profits and foreign-sourced dividends and other incomes if any.

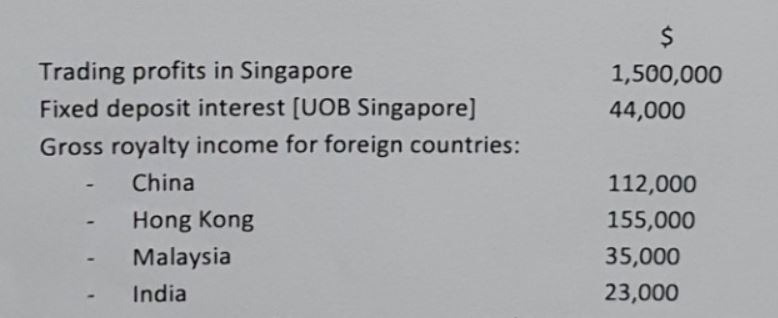

4. Is there any administrative concession for such foreign-sourced income Brighton investment is a Singapore resident company which had the following incomes for the year.

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

All the above foreign-sourced income was remitted into Singapore in December 2019.

Singapore has tax treaties with China, Malaysia, and India but no treaty with Hong Kong. The withholding tax rates in foreign countries are:

- Malaysia – 8%

- Hong Kong – 5.5%

- China – 10%

- India – 10%

Determine the final tax liability for Brighton Pte Ltd for the year of assessment 2020 after allowing the partial exemptions.

5. The above report should turn it in with the Harvard referencing method.

6. An Executive Summary [ONE PAGE ONLY] is preferable. [It is not included on word count]

Our expert assignment writers team has experience of too many years in academic writing. They have adequate knowledge of Singapore taxation. We deliver quality work on time for taxation assignments to SUSS university students. Our work is well researched and error-free. To ease your work we have a free Tax assessment sample for you.

Looking for Plagiarism free Answers for your college/ university Assignments.

- ComfortDelGro Organisational Design Assignment Report: ESG Alignment with UNGC Principles & Sustainability Strategy

- Bomb Threat Management Assignment: Incident Response Plan for High-Risk Facilities in Singapore

- Security Concept Plan Assignment Report: International School Campus Protection Strategy at Jurong East

- CM3065 Intelligent Signal Processing Assignment Report: Midterm Exercises on Audio Captcha, Steganography & Speech Recognition

- BUS306 Risk Assessment Case Study: Outback Retail Ltd Audit Strategy and Substantive Testing Plan

- PSB6013CL Digital Marketing Strategies Project: Exploring Consumer Purchase Intentions in the Fashion E-Commerce Industry

- FinTech Disruption Assignment Report: Case Study on Digital Transformation in Financial Services Industry

- Strategic Management Assignment : Netflix vs Airbnb Case Analysis on Competitive Strategy and Innovation

- Strategic Management Assignment Report: Unilever Case Study on Industry Analysis and Growth Strategy

- PSB6008CL Social Entrepreneurship Assignment Report: XYZ Case Study on Innovation and Sustainable Impact