| University | Singapore University of Social Science (SUSS) |

| Subject | Taxation |

Assignment Overview:

“All foreign incomes received in Singapore are not taxable”. Validate the above statement. Prepare an academic report (not exceeding 1,500 words) on tax implications of foreign income received in Singapore.

1. Provide an extensive discussion of S13(9) of Singapore Income Tax Act;

2. Explain the terms foreign-sourced income and exemptions available in Singapore;

3. Your explanation should include foreign-sourced branch profits and foreign-sourced dividends and other incomes if any.

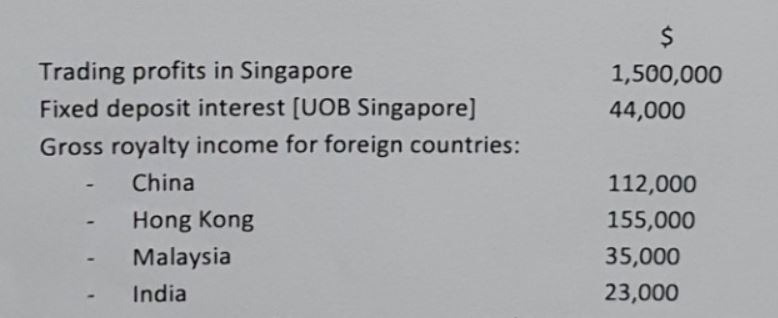

4. Is there any administrative concession for such foreign-sourced income Brighton investment is a Singapore resident company which had the following incomes for the year.

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

All the above foreign-sourced income was remitted into Singapore in December 2019.

Singapore has tax treaties with China, Malaysia, and India but no treaty with Hong Kong. The withholding tax rates in foreign countries are:

- Malaysia – 8%

- Hong Kong – 5.5%

- China – 10%

- India – 10%

Determine the final tax liability for Brighton Pte Ltd for the year of assessment 2020 after allowing the partial exemptions.

5. The above report should turn it in with the Harvard referencing method.

6. An Executive Summary [ONE PAGE ONLY] is preferable. [It is not included on word count]

Our expert assignment writers team has experience of too many years in academic writing. They have adequate knowledge of Singapore taxation. We deliver quality work on time for taxation assignments to SUSS university students. Our work is well researched and error-free. To ease your work we have a free Tax assessment sample for you.

Looking for Plagiarism free Answers for your college/ university Assignments.

- ICT302 Generative AI: Theory and Practice End-of-Course Assessment 2026 | SUSS

- Thermodynamics Project Questions 2026 | Nanyang Technological University

- GSS503 Navigating Risk in an Interconnected World Course Tutor-Marked Assignment 01, 2026

- GSS501 Global Crime Prevention and Security Management Tutor-Marked Assignment 01, 2026

- PSB6012CL Business Research Methods Assignment Brief 2026 | Coventry University

- MTH109 Calculus Tutor-Marked Assignment 1, 2026 | SUSS

- BUS286 Corporate Finance Assignment 2026 | Murdoch University

- HFSY359 Fatigue Management Tutor Mark Assignment Question 2026 | SUSS

- BSE313 Sport Coaching Tutor-Marked Assignment 2 Question 2026 | SUSS

- 6079MP Final Coursework Assignment 2026 | Coventry University