| University | Singapore University of Social Science (SUSS) |

| Subject | ACC302: Advanced Financial Reporting |

Question 1

Paron Co intends to acquire a subsidiary on 1 January 20×0 and has shortlisted one of its regular suppliers, Subsea Co, as a potential candidate. Paron has been buying inventory and property, plant, and equipment (PPE) periodically from Subsea for the past two years.

Paron Co has enough cash to acquire all the shares of Subsea Co but is currently undecided on whether to acquire the shares and how many shares to acquire, if any.

If Paron Co acquires all the shares of Subsea Co, Paron Co would pay $420,000 of cash to the existing shareholders of Subsea Co and record an “investment in Subsea Co” for $420,000 and a reduction of cash of $420,000 in its statement of financial position.

Alternatively, if Paron Co acquires 70% of the shares of Subsea Co, Paron would pay cash of $294,000 to the existing shareholders of Subsea Co and record an “investment in Subsea Co” for $294,000 and a reduction of cash of $294,000 in its statement of financial position.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Assume the following information about the companies:

- The date of acquisition of the shares of Subsea Co is 1 January 20×0.

- On 1 January 20×0, the fair value of net assets of Subsea Co is represented by share capital of $100,000 and retained earnings of $250,000, except for (i) an unrecognized brand that is deemed to be worth $50,000, (ii) a piece of freehold land that was carried at a cost of $100,000 but that had a fair value of $120,000, and (iii) an unrecognized contingent liability for which there is a 30% probability of paying damages of $100,000 and a 70% probability of no payment. Any other excess payment made by Paron Co to acquire Subsea Co

was for goodwill. As of 31 December 20×0, the brand and land had not been sold to external parties, the contingent liability had not been settled, and there were no changes to goodwill. - During February 20×0, Subsea Co will sell machinery (which was carried in its books at a cost of $120,000 less accumulated depreciation of $80,000) to Paron Co for $100,000. The machine had a remaining useful life of 3 years on the date of the intercompany sale.

- During 20×0, Subsea Co will sell inventory which it bought for $40,000 to Paron Co for $60,000. As of 31 December 20×0, 50% of the inventory bought from Subsea Co was not sold to external parties and remained in the store of Paron Co.

- As of 31 December 20×0, Paron Co was deemed to have (i) an unrecognized brand that is deemed to be worth $100,000, (ii) a piece of freehold land that was carried at a cost of $200,000 but that had a fair value of $250,000, and (iii) an unrecognized contingent liability for which there is a 25% probability of paying damages of $100,000 and a 75% probability of no payment.

- The company’s and group’s accounting policies are to carry land and machinery at cost and to depreciate machinery using the straight-line method and provide for a full year’s depreciation if the machinery has been used for more than 6 months during the year.

- The companies’ and group’s accounting policies are to measure inventory using the first-in-first-out method and at the lower of cost and net realizable value.

- The group’s policy is to measure non-controlling interest based on its share of the acquisition-date fair value of identifiable net assets of the subsidiary.

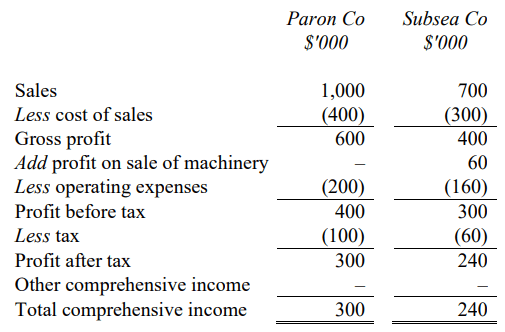

(i) Projected statements of profit or loss and other comprehensive income for the year ended 31 December 20×0

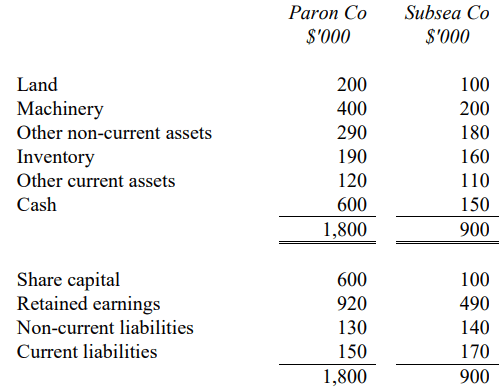

(ii) Projected statements of financial position as of 31 December 20×0.

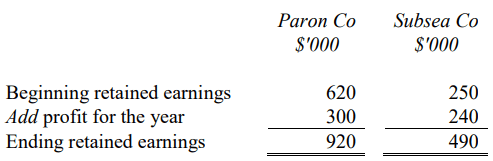

(iii) Projected statements of changes in equity (partial) for the year ended 31

December 20×0

Buy Custom Answer of This Assessment & Raise Your Grades

Facing a time crunch with your ACC302: Advanced Financial Reporting assignment at the Singapore University of Social Science (SUSS)? Relax, because Singapore Assignment Help is your go-to destination for Urgent Assignment Help Services. Our dedicated team of experts is ready to assist you online. With our guidance, you'll excel in your assignment and meet those tight deadlines. Count on our professionalism and reliability to deliver top-quality results. Don't let stress overwhelm you; let us help you achieve academic excellence!

Looking for Plagiarism free Answers for your college/ university Assignments.

- ComfortDelGro Organisational Design Assignment Report: ESG Alignment with UNGC Principles & Sustainability Strategy

- Bomb Threat Management Assignment: Incident Response Plan for High-Risk Facilities in Singapore

- Security Concept Plan Assignment Report: International School Campus Protection Strategy at Jurong East

- CM3065 Intelligent Signal Processing Assignment Report: Midterm Exercises on Audio Captcha, Steganography & Speech Recognition

- BUS306 Risk Assessment Case Study: Outback Retail Ltd Audit Strategy and Substantive Testing Plan

- PSB6013CL Digital Marketing Strategies Project: Exploring Consumer Purchase Intentions in the Fashion E-Commerce Industry

- FinTech Disruption Assignment Report: Case Study on Digital Transformation in Financial Services Industry

- Strategic Management Assignment : Netflix vs Airbnb Case Analysis on Competitive Strategy and Innovation

- Strategic Management Assignment Report: Unilever Case Study on Industry Analysis and Growth Strategy

- PSB6008CL Social Entrepreneurship Assignment Report: XYZ Case Study on Innovation and Sustainable Impact