| University | Singapore Management University (SMU) |

| Subject | Finance |

Question 1:

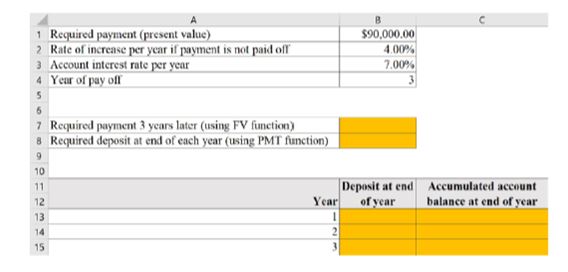

(a) If Project A is completed today. its required payment is $90,000. However. investors decided to pay off the project only at the end of year 3. The required payment for the project will increase by 4% every year.

With this in mind, the investors will deposit an investment amount to a bank account with an interest rate of 7% per year. The deposits will occur at the end of year 1. year 2. and year 3. respectively. Information about this project is shown in the figure below:

- Round your answers to Iwo (2) decimal points. Calculate the project payment amount if it will only be paid three years later and the required deposit at the end of each year if investors were to settle this payment at the end of year 3.

- State the Excel formula for Cell B7 and Cell B8.

- Write down the Excel formulas for Cells B13: C15.

Suppose the investors now decided to increase the yearly deposit by a growth rate g of 3%:

- Calculate the growth-adjusted rate and express it in percentage.

- If the value of the growth rate (3%) is stated in Cell B5, state the Excel formula to calculate the annuity payment at the end of Year 1 +8)).

(b) A $1,000 zero-coupon bond makes payment of the face value at maturity. How would you value the price of a zero-coupon bond and decide if you should buy the zero-coupon bond? Is the bond selling at a premium, at discount, or at par?

(c) Based on your understanding of bond, determine the type of loan that a bond most resembles and state your reasons.

(d) A 9-year. 12% coupon bond with face value $1,000 is priced at $856.85. If we know that the price of the same bond is $741.82 when the YTM is 18%, state the range of the YTM for this bond without using any calculation. Justify your answer.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Question 2

(a) Based on your understanding of the cash flow statement, describe why the information in a cash flow statement is important for an analyst.

(b) For a rapidly expanding company, what kind of trend do you expect to see in its financial statements in two successive years? Determine and define two (2) accounts to look out for and justify your answers.

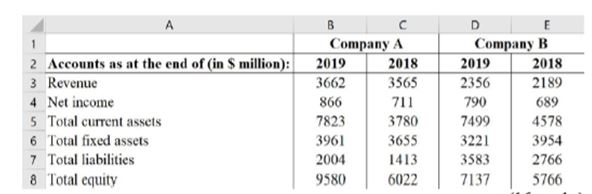

(c) Based on information in the Excel sheet below, utilize the DuPont formula to calculate the Return on Equity (ROE) of Company A and of Company B in 2019 using the following guidelines.

- Round your answers to three (3) decimal points. In your calculation, state the DuPont formula and clearly indicate your steps of calculation for both Company A and Company B.

- Write down the Excel formulas for calculating the net profit margin, asset turnover ratio, and leverage for Company A.

- Interpret the performance of both companies assuming that they are in the same industry.

Question 3

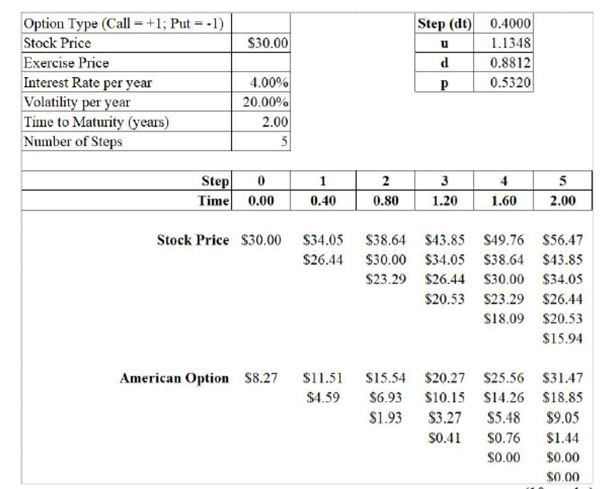

(a) Given the following Binomial tree of an American option. if the exercise price is less than the stock price, indicate whether this is a put option or a call option. Briefly discuss your reasons. Subsequently, answer the following questions. Round your answers to Am (2) decimal points.

- Compute the exercise price of the option.

- If the stock price increases, discuss the effect on the value of the option, assuming that the interest rate, volatility, and time to maturity remain constant.

- What is the present value of the option?

(b) Contrast common stock and preferred stock. Illustrate possible reasons that the price of common stock is usually higher than the price of preferred stock. In what circumstances will the price of a preferred stock be higher than the price of common stock?

(c) Round your answers to two (2) decimal points. Calculate the weighted average cost of capital (WACC) for company XYZ based on the following information. Write the corresponding Excel formula for the calculation.

(d) Analyze the impacts on WACC if there is an increase in both the corporate tax rate and the risk-free rate. Briefly discuss if we should use WACC for a project that is riskier than the average risk of the company’s existing projects.

If you are looking for the most excellent finance assignment writing service, then come to us. We will provide all answers related to personal finance assignments. We have a squad of professional assignment writers who develop such a platform where you can find the solution for all financial problems and achieve A+ grades at SMU university very easily.

Looking for Plagiarism free Answers for your college/ university Assignments.

- ComfortDelGro Organisational Design Assignment Report: ESG Alignment with UNGC Principles & Sustainability Strategy

- Bomb Threat Management Assignment: Incident Response Plan for High-Risk Facilities in Singapore

- Security Concept Plan Assignment Report: International School Campus Protection Strategy at Jurong East

- CM3065 Intelligent Signal Processing Assignment Report: Midterm Exercises on Audio Captcha, Steganography & Speech Recognition

- BUS306 Risk Assessment Case Study: Outback Retail Ltd Audit Strategy and Substantive Testing Plan

- PSB6013CL Digital Marketing Strategies Project: Exploring Consumer Purchase Intentions in the Fashion E-Commerce Industry

- FinTech Disruption Assignment Report: Case Study on Digital Transformation in Financial Services Industry

- Strategic Management Assignment : Netflix vs Airbnb Case Analysis on Competitive Strategy and Innovation

- Strategic Management Assignment Report: Unilever Case Study on Industry Analysis and Growth Strategy

- PSB6008CL Social Entrepreneurship Assignment Report: XYZ Case Study on Innovation and Sustainable Impact