Assignment Facts

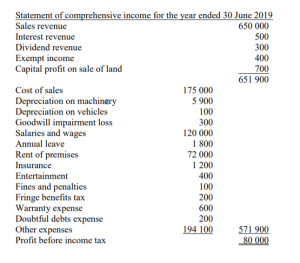

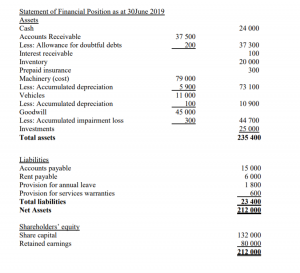

V Ltd was established on 1 July 2018 with share capital of $132 000. One year later the statement of comprehensive income and statement of financial position were as follows:

Other information:

- For tax purposes, depreciation on machinery is $14 000 and for vehicles $300, for the year ended 30 June 2019.

- Doubtful debts, annual leave and service warranties are expensed in the year ending 30 June 2019 but are not deductible for tax purposes until paid.

- V Ltd has accrued annual leave entitlements of $1 800 in calculating net profit for the year ended 30 June 2019.

- Service warranty expense is only deductible as a tax deduction when claimed by customers.

- The company accrues doubtful debts expense as soon as it appears on a customer’s account as uncollectible. However, the bad debt is not allowable as a tax deduction until all avenues to collect the account have been exhausted.

- The tax rate is 30 percent.

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

Required:

1) Complete the journal entry to account for current taxes (5 marks)

2) Complete the deferred tax worksheet (15 marks)

3) Completion of the Statement of Comprehensive Income for the year ended 30 June 2019

(5 marks)

If you are looking for the superb accounting assignment writing help in Singapore then make your way towards SingaporeAssignmentHelp.com. We have an excellent team of experts that finishes your work unique. You just need to pay to do assignment online at low price.

Looking for Plagiarism free Answers for your college/ university Assignments.

- 7WBS2007-0901-2025 Human Resource Management Assignment 1 Brief 2025

- MKTG1270 Product Innovation Management Authentic Case Assessment – Semester 2, 2025

- BSE315 Recreational Sport Programme Management End-of-Course Assessment – July Semester 2025

- CVE2151 Transportation Engineering Assignment – Highway and Traffic Engineering

- Law of property Assignment Part 1 Short Questions

- BPM113 Construction Technology Tutor-Marked Assignment Two July 2025 Presentation

- BC2406 Analytics I: Visual and Predictive Techniques AY2025 Computer Based Assessment (CBA)

- Visual Arts Management Assignment 1 Coursework – Singapore Art Science Museum

- BUS366 Lean Six Sigma End-of-Course Assessment – July Semester 2025

- ELG101 Discovering Language Tutor-Marked Assignments 01-02 July 2025 Presentation