| University | Murdoch University (MU) |

| Subject | BUS307: Commercial Banking |

QUESTION 1a

The market value of the assets of a corporation is currently $15 million. The firm has on the issue a debt outstanding that has a par value of $13.2 million and a due date of exactly five years.

No intermediate interest payments are required. The risk-free (continuous) rate is 5.5% and the standard deviation of returns of the firm’s assets is 60%.

Fortunately, for the bank loan officer, she learns that a dividend of $1.2 million will be paid within days. (Hint: It can be assumed that the dividend will be paid immediately.)

What should be today’s equity value and debt value and the fair interest rate required by the debt holders? State any simplifying assumptions made in your calculations.

QUESTION 1 b

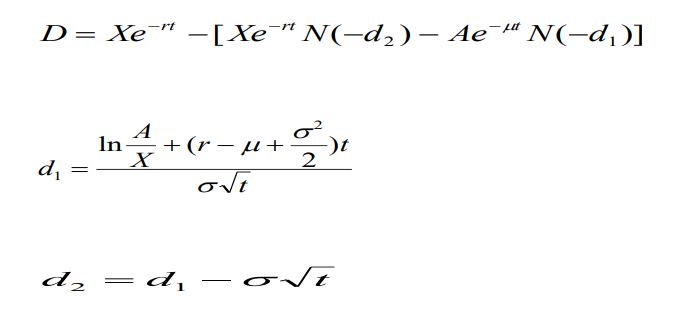

Considering the formulae below, what are the most important variables in driving the computed fair interest rate. Justify your answer.

QUESTION 2

Suppose a borrower knows at time t = 0 that it will have available at time t = 1 an opportunity to invest $85 in a risky project that will pay off at time t = 2. The borrower knows that it will be able to invest in one of two mutually exclusive projects, S or R, each requiring an $85 investment. If the borrower invests in S at time t = 1, the project will yield a gross payoff of $155 with a probability of 0.8 and $45 with a probability of 0.2 at time t = 2. If the borrower invests in R at time t = 1, the project will yield a gross payoff of $170 with a probability of 0.6 and $25 with a probability of 0.4 at time t = 2. The borrower’s project choice is not observable to the bank.

The riskless, single-period interest rate at time t = 0 is 10%. It is not known at time t = 0 what the riskless, single period interest rate at time t = 1 will be, but it is common knowledge that this rate will be 8% (with probability 0.65) or 15% (with probability 0.35). Assume universal risk neutrality and that the borrower has no assets than the project on which you (as the lender) can have a claim. Suppose you are this borrower’s bank and both you and the borrower recognize that this borrower has two choices:

(1) it can do nothing at time t = 0 and simply borrow at the spot market at the interest rate prevailing for it at time t = 1, or

(2) it can negotiate at time t = 0 with you (or some other bank) for a loan commitment that will permit it to borrow at predetermined terms at time t = 1. What advice should you give this borrower? Assume a competitive loan market in which each bank is constrained to earn zero expected profit.

HINTS: Determine the loan commitment fee and NPV of the spot loan and loan commitment.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

QUESTION 3a

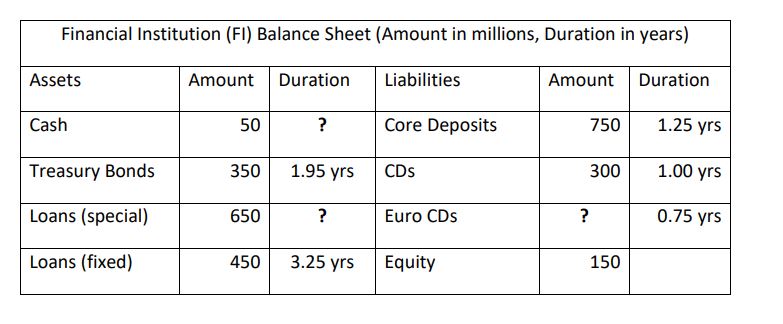

Use this balance sheet information to answer the following questions:

The bank has granted a special loan that has 3 years to maturity and has repayments of $357.875 million at the end of year 1, no payment at the end of year 2 and $357.875 million payment at the end of year 3. The loan is trading at par and the yield to maturity is 5 percent per annum.

The yield curve is flat and the interest rate is 5%. The financial institution decides to use a 3- year swap. The swap is composed of a three-year bond with a fixed coupon rate of 5 percent paid annually and a floating-rate bond with a duration of approximately zero.

Using this swap, determine the notional principal of the swap and advise the financial institution on whether it should be a fixed or floating payer. Present an explanation including pertinent assumptions of how the swap you have recommended works.

QUESTION 3b

What impact does the suspension of loan repayments as the coronavirus crisis hit borrowers have on your analysis? No calculations are required.

QUESTION 4

The ALCO committee believes that (Delta) R/ 1+R= 0.01 would be a reasonable estimate of relevant interest rate movements.

If the 90-day bank bill futures are quoted at 96.0 and there is no basis risk, calculate the number of future contracts to macro-hedge the bank’s balance sheet.

Show all calculations and specifically state whether a short or long position is recommended.

We have professional online assignment helpers who deal with complex (BUS307) Commercial Banking assignments of Murdoch University (MU) to provide quality solutions to the students. Students who have already taken assignment help from Singapore Assignment Help are highly satisfied with the expert services provided by our writers.

Looking for Plagiarism free Answers for your college/ university Assignments.

- Wellbeing Assignment: University Students’ Perspectives for Improving Mental Health Support

- BCLO001 Business Statistics Assignment: Analysis of Exercise Duration Among Singaporean Students

- BM4364 Customer Experience Assignment: Evaluating CX Practices Through Employee Insights in the Service Industry

- GSFM7514 Accounting & Finance Assignment: SAC Services & MEMC Budgeting and CCID Investment Evaluation

- BM0973 BCRM Assignment: Genting Highlands Case Study for Crisis Response and AI-Supported Recommendations

- AC0779 Strategic Management Assignment Essay: Key Activities & Importance in Dynamic Healthcare Settings

- ComfortDelGro Organisational Design Assignment Report: ESG Alignment with UNGC Principles & Sustainability Strategy

- Bomb Threat Management Assignment: Incident Response Plan for High-Risk Facilities in Singapore

- Security Concept Plan Assignment Report: International School Campus Protection Strategy at Jurong East

- CM3065 Intelligent Signal Processing Assignment Report: Midterm Exercises on Audio Captcha, Steganography & Speech Recognition