| University | Macquarie University (MU) |

| Subject | AFIN3010: Issues in Applied Finance |

Topic: An Overview of Risks in Banking and Investments

Case Study: The Australian Airline Industry

Qantas Airways and Virgin Australia

Qantas Airways Limited provides transportation of passengers through two airlines including Qantas (full-service carrier) and Jetstar (low-cost carrier), operating international, domestic and regional services. The Company also includes Qantas Frequent Flyer and Qantas Freight which generates diverse revenue streams and adds value for customers and investors.

Qantas Airways, Australia’s #1 airline, flies to more than 200 destinations (including some served by code-sharing partners) in more than 45 countries. (Code-sharing enables carriers to sell tickets on one another’s flights and thus extend their networks.) Qantas owns regional carrier QantasLink and low-fare carrier Jetstar, both of which operate in Australia and the Asia/Pacific region. Overall, the Qantas fleet includes 300 aircraft. The company also generates revenue from cargo, catering, and tourism operations. Qantas is part of the Oneworld alliance, which is led by British Airways and American Airlines.

Virgin Australia Holdings Limited is an Australian-based full-service airline providing domestic and international operations. Australia and the Asia/Pacific remain Virgin territory for low-fare airlines. Virgin Blue Holdings’ main subsidiary, Virgin Blue Airlines, serves more than 20 cities in Australia, where it is #2 behind Qantas. Virgin Blue carriers include Pacific Blue, which serves New Zealand, and Polynesian Blue, which flies to several Pacific islands. In early 2009 Virgin Blue launched V Australia, an airline flying between Australia and the US West Coast. Overall, Virgin Blue operates a fleet of about 75 Boeing 737s and Embraer E-Jets and serves some 30 destinations. The company also sells tour packages and offers cargo services. UK-based Virgin Group holds a 26% stake in Virgin Blue. Source: Bloomberg

Please refer to data available on FACTSET, Yahoo Finance, the company annual report and website to learn more about Qantas Airways and Virgin Australia.

Purpose of this Assignment

As both Qantas Airways and Virgin Australia are locally based carries- which are publicly listed companies and also have debt issuances in the investment market via bonds – you have been assigned to evaluate any risks associated with investing in these companies.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Question One

Compare and contrast the credit ratings assigned by either Fitch, Moodys or S&P Ratings (any single agency can be used for comparison) to these companies. Based on your research, please describe three key reasons for the difference in ratings assigned to each. Please provide some supporting information from their financial statements in FY2019.

Question Two

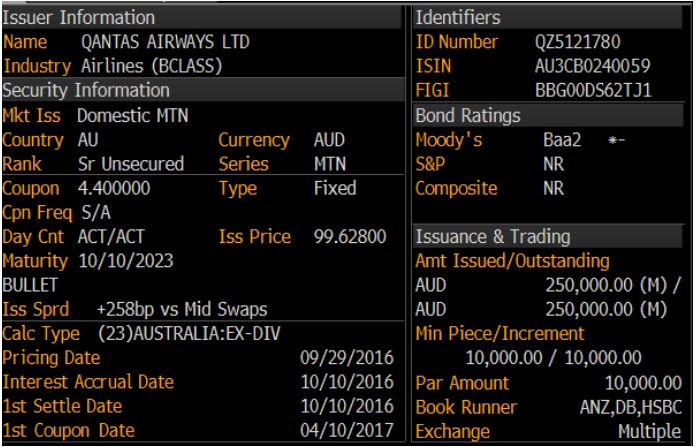

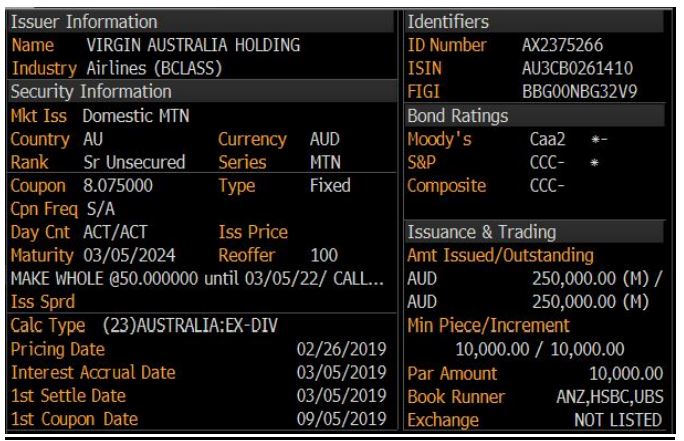

Below are examples of bonds issued by Qantas Airways and Virgin Australia. Calculate the credit risk premium based on the current yields for each bond.

Qantas Airways 4.4% 2023

Assumptions

Bid Price: 101

Offer Price: 103

Yield to Maturity (Offer): 3.47%

(Note: Use a comparable 4-year risk-free proxy for calculation)

Virgin Australia

Assumptions

Bid Price: 40

Offer Price: 50

Yield to Maturity (Offer): 31%

(Note: Use a comparable 4-year risk-free proxy for calculation)

Identify two key differences between the terms of each bond (based on the information provided above).

Calculate the bid/offer spread of each bond. Which bond has higher liquidity risk?

Question Three

Calculate the beta for Virgin Australia and Qantas Airways Shares using daily returns in excel.

- Using weekly data returns from March 2018- March 2020

- use the ASX200 as the market index

Provide a summary of calculations as to how you arrived at the final Beta figure.

Which stock has a higher beta and what does it imply for each of the stock?

Question Four

Identify two additional risks a global investor could face while investing in Qantas and Virgin Australia shares and bonds over the next six to twelve months.

Get the quality assignment help for AFIN3010: Issues in Applied Finance course of Macquarie University (MU) at the best price only from the expert assignment writers of Singapore Assignment Help. Avail complete support and get rid of the stress of writing different finance assignments and personal finance assignments.

Looking for Plagiarism free Answers for your college/ university Assignments.

- Wellbeing Assignment: University Students’ Perspectives for Improving Mental Health Support

- BCLO001 Business Statistics Assignment: Analysis of Exercise Duration Among Singaporean Students

- BM4364 Customer Experience Assignment: Evaluating CX Practices Through Employee Insights in the Service Industry

- GSFM7514 Accounting & Finance Assignment: SAC Services & MEMC Budgeting and CCID Investment Evaluation

- BM0973 BCRM Assignment: Genting Highlands Case Study for Crisis Response and AI-Supported Recommendations

- AC0779 Strategic Management Assignment Essay: Key Activities & Importance in Dynamic Healthcare Settings

- ComfortDelGro Organisational Design Assignment Report: ESG Alignment with UNGC Principles & Sustainability Strategy

- Bomb Threat Management Assignment: Incident Response Plan for High-Risk Facilities in Singapore

- Security Concept Plan Assignment Report: International School Campus Protection Strategy at Jurong East

- CM3065 Intelligent Signal Processing Assignment Report: Midterm Exercises on Audio Captcha, Steganography & Speech Recognition