| University | PSB Academy |

| Subject | ACFI2012 Accounting for Corporate Entities |

Part A: Essay (40 marks)

In their article entitled ‘U.S. firms challenged to get “intangibles” on the books’, Byrnes and Aubin (2011) noted that in the United States some companies were accounting for intangibles such as brands, patents and information technology diƯerently when they were developed internally rather than being acquired. This could mean major diƯerences in accounting numbers where internally generated intangibles developed at low costs by one company were sold for

large amounts to another company. They noted:

The accounting difference could result in distorted behaviour, warns Abraham BriloƯ, a professor emeritus of accountancy at Baruch College, tempting companies to buy intellectual property rather than doing research themselves. . .

Required

- Explain the accounting for internally generated intangible assets in AASB 138/IAS 38.

- Discuss any diƯerences between accounting for internally generated intangible assets and acquired intangible assets in AASB 138/IAS 38.

- Discuss why shareholders and lenders may be reluctant to press for changes in AASB 138/IAS 38 to require more recognition of internally generated intangible assets.

- Explain why managers of organisations would prefer changes in AASB 138/IAS 38 to require more recognition of internally generated intangible assets.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Part B: (60 marks)

On 1 August 2024, Severus Ltd issued a prospectus inviting applications for 400 000 ordinary shares to the public at an issue price of $6.00, payable as follows:

- $2.00 on application (due by closing date of 1 November 2024)

- $2.50 on allotment (due 1 December 2024)

- $1.50 on future call/calls to be determined by the directors

By 1 November, applications had been received for 430 000 ordinary shares of which applicants for 50 000 shares forwarded the full $6.00 per share, applicants for 150 000 shares forwarded $4.50 per share and the remainder forwarded only the application money.

At a directors’ meeting on 7 November, it was decided to allot shares in full to applicants who had paid the $6.00 or $4.50 on application, to reject applications for 10 000 shares and to proportionally allocate shares to all remaining applicants. According to the company’s constitution, all surplus money from application can be transferred to Allotment and/or Call accounts.

Share issue costs of $20 000 were also paid on 7 November. All outstanding allotment money was received by the due date.

A first call for $0.80 was made on 1 February 2025 with money due by 1 March. All money was received by the due date. A second and final call for $0.70 was made on 1 June with money due by 18 June. All money was received by the due date.

Required

a) Prepare a schedule that shows the numbers of shares applied for, numbers of shares allotted, total cash received, cash received that relates to application, cash received that relates to allotment, cash received that relates to calls, cash refunded. (24 marks)

b) Prepare journal entries to reflect all transactions for the year end 30 June 2025. (36 marks)

Note: the entries should be displayed in date order of the underlying transaction. The detailed calculations and relevant description should be listed below each entry

Buy Custom Answer of This Assessment & Raise Your Grades

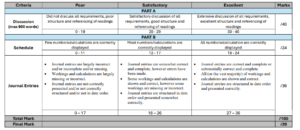

Marking Criteria for Writing Assignment

Looking for Plagiarism free Answers for your college/ university Assignments.

- ComfortDelGro Organisational Design Assignment Report: ESG Alignment with UNGC Principles & Sustainability Strategy

- Bomb Threat Management Assignment: Incident Response Plan for High-Risk Facilities in Singapore

- Security Concept Plan Assignment Report: International School Campus Protection Strategy at Jurong East

- CM3065 Intelligent Signal Processing Assignment Report: Midterm Exercises on Audio Captcha, Steganography & Speech Recognition

- BUS306 Risk Assessment Case Study: Outback Retail Ltd Audit Strategy and Substantive Testing Plan

- PSB6013CL Digital Marketing Strategies Project: Exploring Consumer Purchase Intentions in the Fashion E-Commerce Industry

- FinTech Disruption Assignment Report: Case Study on Digital Transformation in Financial Services Industry

- Strategic Management Assignment : Netflix vs Airbnb Case Analysis on Competitive Strategy and Innovation

- Strategic Management Assignment Report: Unilever Case Study on Industry Analysis and Growth Strategy

- PSB6008CL Social Entrepreneurship Assignment Report: XYZ Case Study on Innovation and Sustainable Impact