| University | Singapore University of Social Science (SUSS) |

| Subject | FMT306e: Strategic Asset Property & Facilities Management |

Question 1

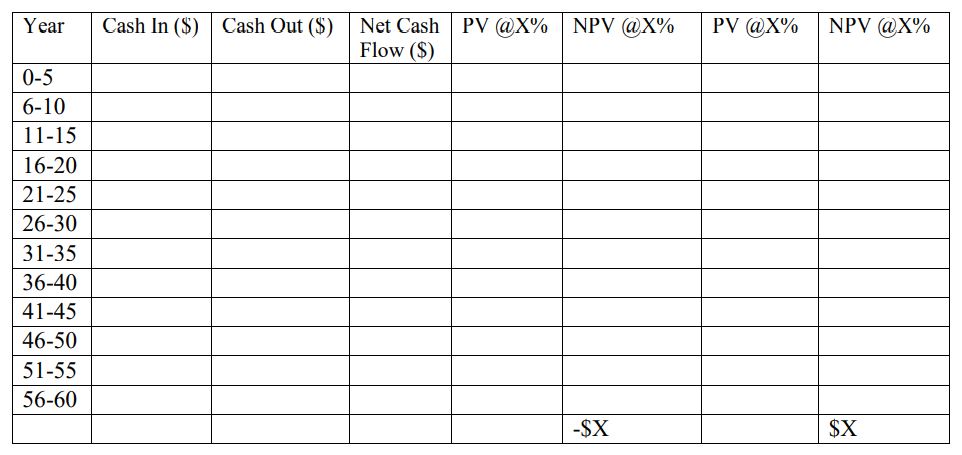

Assuming you are the asset manager of the joint venture company created for this project, with the aid of MS Excel, appraise the rate of return for this white site using a discounted cash flow analysis.

Embed your MS Excel file into your MS Word file (MS Word>INSERT>Object>Create from File>Browse>Select your MS Excel file>Insert>Select “Display as an icon”>Click “OK”).

Use the following assumptions:

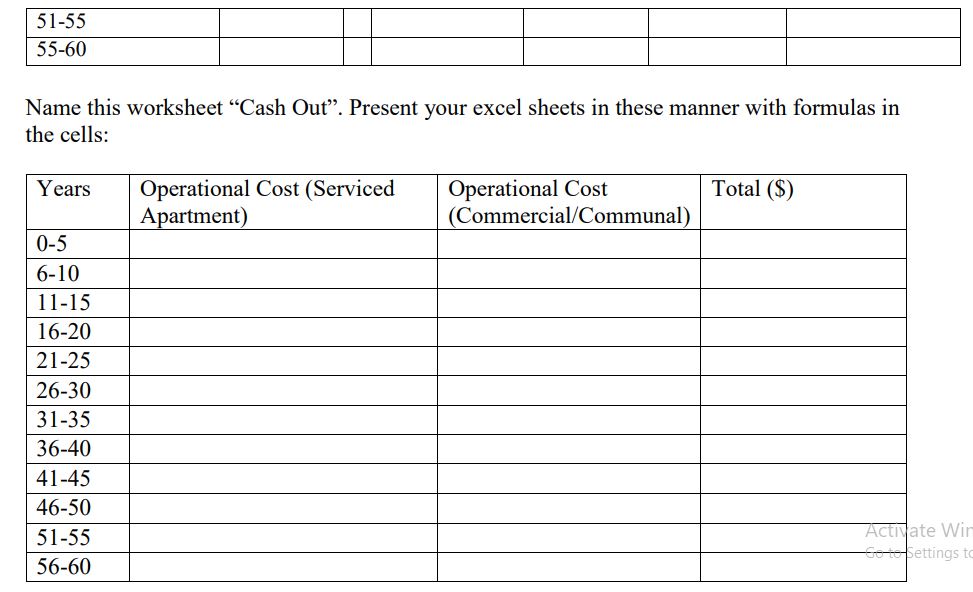

Construction cost of commercial element = $2700/m²

Construction cost of serviced apartment = $2950/m²

Construction cost of communal facilities = $3000/m²

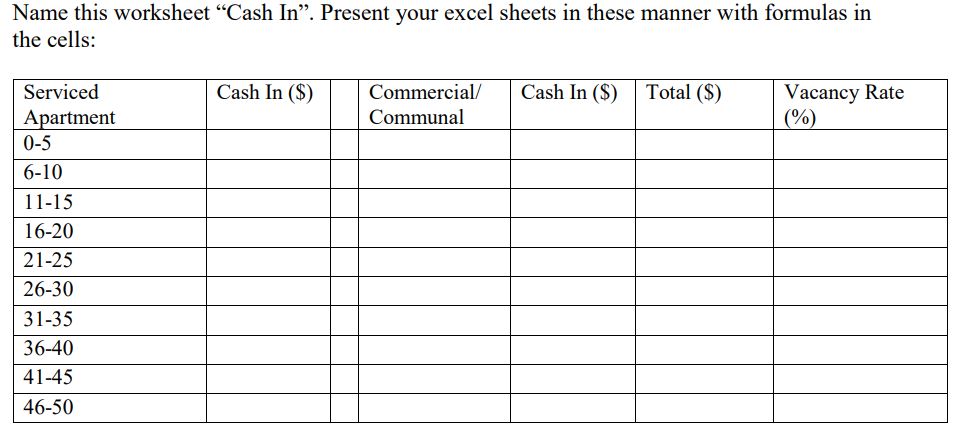

The ratio of lettable floor area to gross floor area = 0.9: 1

Commercial/Communal monthly rental = $15 psf

Service apartment rental = $10 psf

Monthly operating cost = $1 psf

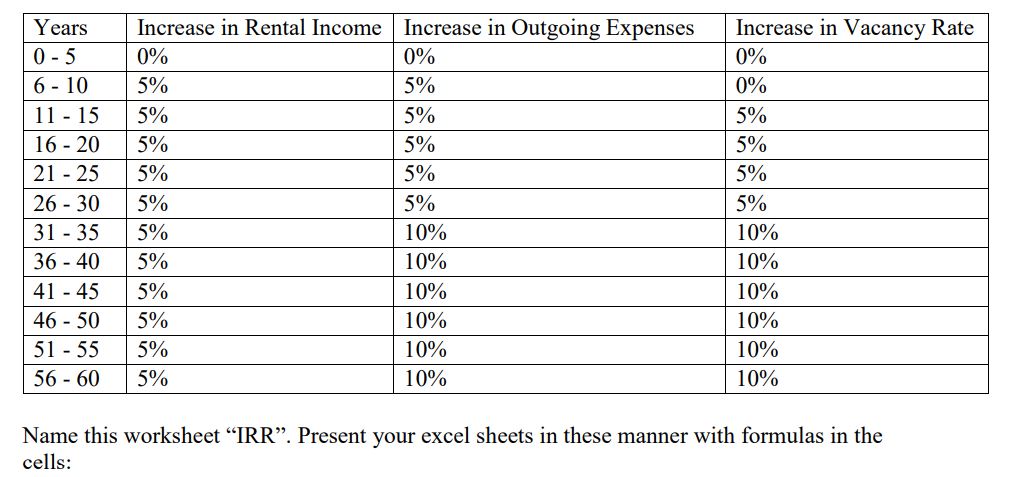

Every 5 years of rental income and outgoing expenses increase by 5%

Outgoing expenses increase by 10% after Year 30

The lifespan of proposed building = 60 years

Vacancy rate = From Year 10 onwards, every 5 years at 5%. From year 30, every 5 years at 10%.

1 m² = 10.7639 feet²

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Question 2

Assuming you are a facilities asset manager and you found a piece of land that would be perfect for your asset portfolio.

a. Recommend the two approaches you can use to appraise the land and give an offer to the seller?

b. Demonstrate the process of your appraisal to justify the offer to the seller for the piece of land.

Question 3

Comparing the Net NPV and IRR figures in Question 1, answer the following questions:

a. Appraise the figures of NPV and IRR in Question 1.

b. Demonstrate the key reasons for facilities asset managers to calculate both NPV and IRR.

c. Which method is more suitable to help an asset manager make a more realistic long term investment project decision? Appraise the reasons for your selection.

d. In the analysis of both NPV and IRR, demonstrate which methodology do not have a discount rate issue.

If you want your custom (FMT306e) Strategic Asset, Property & Facilities Management assignment help, then hire a professional assignment writer. Everything is affordable, legal, and confidential. Also, get the Asset Management assignment help to get excellent marks at SUSS university.

Looking for Plagiarism free Answers for your college/ university Assignments.

- GSS503 Navigating Risk in an Interconnected World Course Tutor-Marked Assignment 01, 2026

- GSS501 Global Crime Prevention and Security Management Tutor-Marked Assignment 01, 2026

- PSB6012CL Business Research Methods Assignment Brief 2026 | Coventry University

- MTH109 Calculus Tutor-Marked Assignment 1, 2026 | SUSS

- BUS286 Corporate Finance Assignment 2026 | Murdoch University

- HFSY359 Fatigue Management Tutor Mark Assignment Question 2026 | SUSS

- BSE313 Sport Coaching Tutor-Marked Assignment 2 Question 2026 | SUSS

- 6079MP Final Coursework Assignment 2026 | Coventry University

- IBUS2004 Managing International Business Assessment 1 Brief 2026 | UON

- BSL305 Company Law Assignment 2026 | Murdoch University