| University | Singapore University of Social Science (SUSS) |

| Subject | Finance |

1 Portfolio Insurance

Your Portfolio has a beta of 2 and its current value is $500,000. The index currently stands at 1,000. The risk-free rate is 2%. The dividend yield on both the portfolio and the index is 3%.

1. You want to have insurance against the portfolio value falling below $450,000 over the next year using the index put option. How many index put options are necessary?

2. Find the strike price of the index put option.

3. Suppose now that the index level after one year becomes 900. What is the expected portfolio value in this scenario? What is the total payoff from the index put options? The sum of two is greater than the protection level, $450,000?

2 One-period Binomial Tree

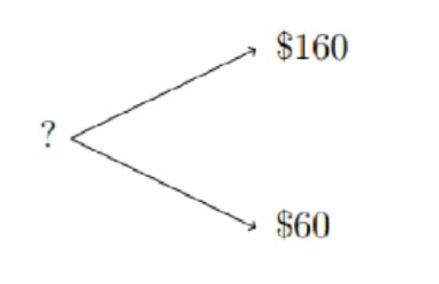

Below is an l-period binomial tree with T-1. The risk-free rate is 10% and the dividend yield is zero. The tree probability of an up move is 0.65 and the take risk-neutral probability of an up move is 0.6.

1. What is the current stock price?

2. What is the true expected return of the stock?

3 What is the price of a 70-strike European call option?

4 Based on the price of a 70-strike European call option you found, find the “true” discount rate of the option.

5 What is the price of a 70-strike American call option?

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

3 Black-Scholes-Merton Formula

Consider a 3-month American call option with strike $41.5 on a non-dividend paying stock. The volatility of the stock is 30%. Assume that the Black-Scholes-Merton framework holds and that the delta of the call option today is 0.5. The risk-free rate is 10.22%.

1. What is the delta of a 3-month European put option on the same stock with strike $41.5?

2. What is the price of the European put option?

4 Power Option

An option whose payoff is based on the price of an underlying asset raised to a power is called a power option. For this exercise, we will consider a European power call option. Its payoff at maturity is max(St^2 – 750,0) where the maturity T is 1-year. That is, the option pays the square of the stock price less the strike price of $750 if the owner of the option exercises.

1. Draw the payoff diagram of the European power call option at the maturity. What is the payoff when the stock price is $40 at the maturity? From what value of the stock price is the payoff positive?

2. Assume now that the risk-free rate is 15%, and the current stock price is $20. Consider a two-period binomial tree with gross returns are 150% and 75% in an up move and a down move, respectively.

(a). What is the volatility of the stock and the dividend yield?

(b). What is the risk-neutral probability of an up move?

(c). Find the European power call option price using the two-period binomial tree.

(d). Now, consider an American power call option. In this case, you receive max (St^2 – 750,0) when you exercise at time t. Find the American power call option price using the two-period binomial tree. Will you exercise early?

Are you having a hard time writing your derivatives securities assignment? Derivatives Securities (FIN359) assignment can give a really hard time if students don’t have sound knowledge on various derivatives related topics. That is the reason we offer assignment help for derivative securities to SUSS university students at an affordable price. We also have the best solutions for finance assignments that are very complex.

Looking for Plagiarism free Answers for your college/ university Assignments.

- EGH222 Healthcare Analytics Assignment 2: Predictive Model for Sick Days Based on Employee Demographics and Lifestyle Data

- Sustainability Strategy Assignment: Selected Company Case Study on Addressing Sector Challenges and Driving Behavioural Change Campaigns

- 7WBS2012 Executive Career Development Assignment: Career Pathway & Readiness Post-MBA in Education Management

- CVE2322 Gantry Build Prototype Assignment: Sustainable Civil Engineering Model Using Recyclable Materials

- BMG706 Strategic Quality Change Assignment Report: Enhancing Operational Excellence at any Organization

- CVE2323 Structural Analysis Assignment: Matrix Method & STAAD.Pro Evaluation of Frame Systems

- BMK3015 Major Project Assignment: Customer-Centric Design Solutions Using Research & Project Management

- Wellbeing Assignment: University Students’ Perspectives for Improving Mental Health Support

- BCLO001 Business Statistics Assignment: Analysis of Exercise Duration Among Singaporean Students

- BM4364 Customer Experience Assignment: Evaluating CX Practices Through Employee Insights in the Service Industry