Assignment Details:

Question 1

You recently received a bonus of $8,000 and are thinking of investing this sum of money for your retirement 20 years later. Sandy Chen, your financial planner, approached you recently an offered two investment products.

Product Aee will earn an annual return of 5% per year for the first 5 years. If there is no recession in Singapore during the first 5 years, all amounts invested will earn an annual return of 7% for the next 10 years, otherwise, returns will be 3% per year.

Alternatively, Product Bee allows you to invest $800 per year (at the beginning of each year) for the next 10 years. It will earn a return of 5% per year. This product will mature 20 years later.

Over the next two decades, the deposit rate offered by local banks is expected to be 2% per year, which is compounded daily. Whereas, lending rates are expected to be 6% per year (compounded monthly).

Based on a recent article you read from Business Times, economists have predicted that there will be a 70% chance of a recession happening over the next several years.

(a) Calculate the amount you expect to receive at the end of 15 years for Product Aee if there is no recession during the first 5 years.

(4 marks)

(b) Calculate the amount you expect to receive at the end of 15 years for Product Aee if there is a recession during the first 5 years.

(3 marks)

(c) Calculate the value of Product Bee on maturity.

(4 marks)

(d) Calculate the effective interest rate of both deposit and lending rates.

(4 marks)

(e) Determine and justify which investment product you should choose. State any assumptions made.

(10 marks)

Buy Custom Answer of This Assessment & Raise Your Grades

Question 2

3 years ago, Blue Horizon Ltd (a company listed on Singapore Exchange operating in the logistics industry), issued 50,000 (with a face value of $1,000 each) 6% coupon (payable semi-annually) 10-year bonds at a discount of 20%.

Since then, Blue Horizon Ltd has generated significant profits and its credit rating has improved from B to Baa recently. As a result, its current borrowing costs have been reduced by 50 basis points.

Given the explosion of e-commerce and its recent success, the board has decided to expand its business operation into regional markets like Malaysia and Vietnam. In order to do so, they plan to issue more bonds. You have been approached by the board to advise them on how best to structure the impending bond issue such that interest cost is minimised.

The earnings per share (EPS) in the most recent financial year i.e. FY 2018 was $15.50. In FY 2014, it was $12. During the most recent earnings conference call, management shared that EPS is expected to grow at 3% per year, forever. Blue Horizon Ltd adopts a 60% dividend pay-out policy and currently trades at $280.

(a) Calculate the dollar amount of coupon payable on the bond every 6 months and the yield-to-maturity of the bonds 3 years ago when it was issued by Blue Horizon Ltd.

(5 marks)

(b) Calculate the yield-to-maturity and the price of each bond today.

(5 marks)

(c) Recommend and justify three (3) things the board can do to reduce the coupon rate of the impending bond issuance.

(6 marks)

(d) Calculate Blue Horizon Ltd’s cost of equity assuming the market applies the dividend growth model.

(8 marks)

(e) Suppose the yield to maturity of the bond obtained in part (b) turned out to be higher than the cost of equity computed in part (d). Interpret and discuss this finding.

(6 marks)

Question 3

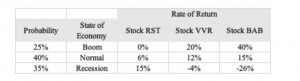

Ravi, a fund manager working for a private equity firm headquartered in Singapore, is considering including the following stocks in the firm’s portfolio:

He plans to invest 40% of the portfolio funds in stock RST and the balance equally between VVR and BAB. Beta of stock VVR is 0.15 higher than RST.

The firm’s in-house economist anticipates the probability of boom, normal and recession to be 25%, 40% and 35% respectively. The yield on long term government securities is 3% per year.

(a) Calculate the expected return and standard deviation for each stock.

(6 marks)

(b) Calculate the expected return, expected risk premium and standard deviation for the portfolio.

(4 marks)

(c) Interpret your answer for part (a) and (b) and advise Ravi on his asset allocation plan for the portfolio.

(6 marks)

(d) Compute the expected market risk premium assuming capital asset pricing model holds.

(4 marks)

(e) Explain whether stock RST or stock VVR is riskier.

(5 marks)

Question 4

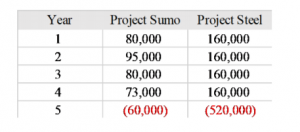

Decacorn Capital LLP (“Decacorn”) is evaluating two greenfield solar energy projects with the following forecasted free cash flows:

The initial investment for Project Sumo and Project Steel is $200,000 and $170,000 respectively. Decacorn would like to invest in only one project and uses a discount rate of 12% for solar energy projects.

Besides the solar energy projects, there is another investment opportunity to acquire a ride-hailing business, Easy Ride Pte Ltd (“Easy Ride”). Currently, this firm does not have any debt and its cost of equity is estimated to be 18%. Post-acquisition, Decacorn intends to change Ride Easy’s debt-to-equity ratio to 0.25. The firm is envisaged to have a borrowing cost is 7% and corporate tax rate is 17%.

(a) Calculate the net present value (NPV) and internal rate of return (IRR).

(5 marks)

(b) Calculate the modified IRR for Project Steel.

(3 marks)

(c) Interpret your answer for part (b) and (c) and advise Decacorn which project it should undertake.

(6 marks)

(d) Calculate Easy Ride’s weighted average cost of capital (WACC) post-acquisition. Assume Modigliani and Miller (M&M) theory with tax holds true.

(6 marks)

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

SingaporeAssignmentHelp.com is here with its excellent MBA assignment help services for the students at the low price possible. Our writers are proficient helpers in all the areas of academics and delivers a great university assignment help.

Looking for Plagiarism free Answers for your college/ university Assignments.

- 7WBS2012 Executive Career Development Assignment: Career Pathway & Readiness Post-MBA in Education Management

- CVE2322 Gantry Build Prototype Assignment: Sustainable Civil Engineering Model Using Recyclable Materials

- BMG706 Strategic Quality Change Assignment Report: Enhancing Operational Excellence at any Organization

- CVE2323 Structural Analysis Assignment: Matrix Method & STAAD.Pro Evaluation of Frame Systems

- BMK3015 Major Project Assignment: Customer-Centric Design Solutions Using Research & Project Management

- Wellbeing Assignment: University Students’ Perspectives for Improving Mental Health Support

- BCLO001 Business Statistics Assignment: Analysis of Exercise Duration Among Singaporean Students

- BM4364 Customer Experience Assignment: Evaluating CX Practices Through Employee Insights in the Service Industry

- GSFM7514 Accounting & Finance Assignment: SAC Services & MEMC Budgeting and CCID Investment Evaluation

- BM0973 BCRM Assignment: Genting Highlands Case Study for Crisis Response and AI-Supported Recommendations