Assignment Details:

Question 1

(a) Explain what autarky is and how has that changed with international economics based on comparative advantage and Heckscher-Ohlin theory.

(b) Will a capital-abundant country like Singapore have relatively high or low interest rates as the “price of capital”?

(c) Discuss with trade, for a relatively labour-abundant country like Indonesia which specialises in the production of labour-intensive goods, interest rates will rise or fall. With trade for Singapore as relatively capital-abundant which specialises in the production of capital-intensive goods, will interest-rates rise or fall?

(d) From your answers, what follows with respect to differences in interest rates in Indonesia and Singapore? Will a labourer or capital owner in Singapore, gain more from trade? Will this change over time and how?

(25 marks)

Question 2

Analyse how a tariff on the importation of a commodity leads to economic inefficiencies that detract from national welfare of (a) a small nation (b) a large nation. What factors influence the size of revenue, protective, consumption and redistributive effects of a tariff in both cases? Explain with appropriate diagram(s) for a small nation and a big nation.

(25 marks)

Question 3

Given the table below for Singapore’s Balance of Payments, answer the following questions:

(a) For 2010-2016, comment on the Goods Balance in healthy positive figures while being negative for Services Balance has also widened.

(b) Explain how the Capital & Financial Balance or Capital Account has grown to exceed the Current Account Balance by 2016.

(c) With Reserves Assets remaining healthy, but smaller in 2016, what are the

implications for the strength of the Singapore dollar?

(d) With a diagram on a managed floating exchange rate, how is Singapore able to straddle between fixed and free exchange rates?

(25 marks)

Question 4

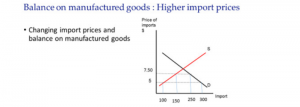

Consider an exogenous increase in the price of imported manufactured goods from $5 to $7.50 in the figure above (no concern of exchange rate system as fixed or flexible). Answer the questions as follows:

(a) What is the change in quantity supplied? (1 mark)

(b) What is the change in domestic quantity demanded? (1 mark)

(c) What is the change in imports? (1 mark)

(d) What is the change in import spending? (1 mark)

(e) What is the revenue of domestic firms? (2 marks)

(f) What is the import elasticity? (5 marks)

(g) Given the answer in (e), is the demand for imports elastic or inelastic? (2 marks)

(h) What can be implied from (f) with respect to price and import spending? (2 marks)

(i) Compare import substitution and export orientation, that is, like what to conclude whether a higher price for imports increases or decreases import spending with reasons you may suggest. (10 marks)

Buy Custom Answer of This Assessment & Raise Your Grades

The proficient writers at SingaporeAssignmentHelp.com delivers an excellent help in economics homework. Our writers are well-aware with all your university guidelines and instructions. Thus we work hard and present you cheap essay writing services to score high.

Looking for Plagiarism free Answers for your college/ university Assignments.

- CM3065 Intelligent Signal Processing Assignment Report: Midterm Exercises on Audio Captcha, Steganography & Speech Recognition

- BUS306 Risk Assessment Case Study: Outback Retail Ltd Audit Strategy and Substantive Testing Plan

- PSB6013CL Digital Marketing Strategies Project: Exploring Consumer Purchase Intentions in the Fashion E-Commerce Industry

- FinTech Disruption Assignment Report: Case Study on Digital Transformation in Financial Services Industry

- Strategic Management Assignment : Netflix vs Airbnb Case Analysis on Competitive Strategy and Innovation

- Strategic Management Assignment Report: Unilever Case Study on Industry Analysis and Growth Strategy

- PSB6008CL Social Entrepreneurship Assignment Report: XYZ Case Study on Innovation and Sustainable Impact

- MBA Financial Management Global Case Study Assignment: Corporate Valuation & Investment Analysis

- CM1040 Web Development Presentation: Connecting Responsive Design with Data Security

- 7WBS2009 Financial Management Assignment Report: Ratio Analysis and Investment Decision for Alpha and Beta plc