Assignment Facts

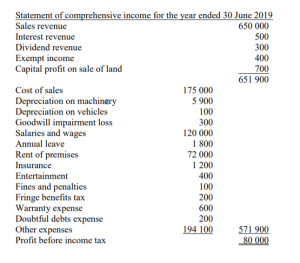

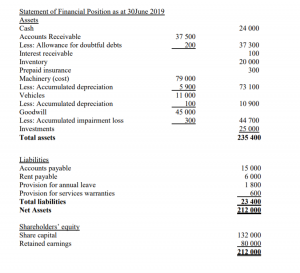

V Ltd was established on 1 July 2018 with share capital of $132 000. One year later the statement of comprehensive income and statement of financial position were as follows:

Other information:

- For tax purposes, depreciation on machinery is $14 000 and for vehicles $300, for the year ended 30 June 2019.

- Doubtful debts, annual leave and service warranties are expensed in the year ending 30 June 2019 but are not deductible for tax purposes until paid.

- V Ltd has accrued annual leave entitlements of $1 800 in calculating net profit for the year ended 30 June 2019.

- Service warranty expense is only deductible as a tax deduction when claimed by customers.

- The company accrues doubtful debts expense as soon as it appears on a customer’s account as uncollectible. However, the bad debt is not allowable as a tax deduction until all avenues to collect the account have been exhausted.

- The tax rate is 30 percent.

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

Required:

1) Complete the journal entry to account for current taxes (5 marks)

2) Complete the deferred tax worksheet (15 marks)

3) Completion of the Statement of Comprehensive Income for the year ended 30 June 2019

(5 marks)

If you are looking for the superb accounting assignment writing help in Singapore then make your way towards SingaporeAssignmentHelp.com. We have an excellent team of experts that finishes your work unique. You just need to pay to do assignment online at low price.

Looking for Plagiarism free Answers for your college/ university Assignments.

- Wellbeing Assignment: University Students’ Perspectives for Improving Mental Health Support

- BCLO001 Business Statistics Assignment: Analysis of Exercise Duration Among Singaporean Students

- BM4364 Customer Experience Assignment: Evaluating CX Practices Through Employee Insights in the Service Industry

- GSFM7514 Accounting & Finance Assignment: SAC Services & MEMC Budgeting and CCID Investment Evaluation

- BM0973 BCRM Assignment: Genting Highlands Case Study for Crisis Response and AI-Supported Recommendations

- AC0779 Strategic Management Assignment Essay: Key Activities & Importance in Dynamic Healthcare Settings

- ComfortDelGro Organisational Design Assignment Report: ESG Alignment with UNGC Principles & Sustainability Strategy

- Bomb Threat Management Assignment: Incident Response Plan for High-Risk Facilities in Singapore

- Security Concept Plan Assignment Report: International School Campus Protection Strategy at Jurong East

- CM3065 Intelligent Signal Processing Assignment Report: Midterm Exercises on Audio Captcha, Steganography & Speech Recognition