| University | University of Essex (UOE) |

| Subject | BE313: Portfolio Analysis |

Assignment Details:

a. Download the most recent 5 years of monthly closing prices for any two different companies, the stock market benchmark index, and the government securities.

You can use any database to obtain the prices e.g. object, yahoo finance (click the Investing tab followed by the Historical Prices tab), etc. Use the downloaded data to generate average monthly returns. Calculate the annualized average return, the standard deviation of the returns, correlation, and beta of the chosen stocks. You may wish to use excel to perform these calculations. Show your workings clearly.

b. Use investment proportions for the two stocks with intervals of 10%, tabulate the investment opportunity set of the two stocks. Plot the investment opportunity set of the two stocks.

Buy Custom Answer of This Assessment & Raise Your Grades

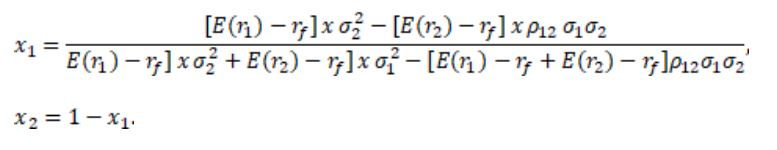

c. Calculate the investment proportions on the optimal risky portfolio consisting of the two stocks, which we denote by stock 1 and stock 2, using the following formulae:

Use the proportions, calculate the expected return and standard deviation of this optimal risky portfolio. Identify the optimal risky portfolio on the diagram for the opportunity set of portfolios.

Discuss in your report diversification referring to the efficient frontier and the expected return and standard deviation of the optimal risky portfolio in your answer.

d. Using the beta obtained in (a), calculate the returns on each stock using the CAPM equation. Discuss whether you think that beta is the adequate risk measure to use for the CAPM?

Compare the expected return using CAPM equation and the expected return found in (a) by subtracting the CAPM predicted return from the historical average return of the stock. This is the amount by which the stock outperformed (+) or underperformed (-) the required return as predicted by CAPM over the historical time period. This is known at the stocks “alpha.”

Graph the Security Market Line (relationship between beta and the expected return) using the risk-free rate from the government securities and the risk premium. On this graph, also graph the average monthly return (from part 1) and beta (from part 2) for each of the three stocks. The distance that the stock lies above the Security Market Line is also the stocks “alpha.”

According to the stocks’ alphas, which stocks outperformed or underperformed historically? Explain why each stock either outperformed or underperformed? Were there special circumstances for any of the companies? Do you think the historical performance will continue? Do you think any of the companies face special circumstances now that will enable them to outperform in the future? Are there any special circumstances that would cause them to under-perform?

Do you often struggle with the Portfolio Analysis assignments? Are you looking for a portfolio analysis assignment help in Singapore? Have you already searched a lot but couldn't find the expert online assignment helper? Don’t be upset. You are now in the right place. We, at Singapore Assignment Help, provide the ultimate solution for investment and portfolio management assignments to Essex university scholars at an affordable price.

Looking for Plagiarism free Answers for your college/ university Assignments.

- EGH222 Healthcare Analytics Assignment 2: Predictive Model for Sick Days Based on Employee Demographics and Lifestyle Data

- Sustainability Strategy Assignment: Selected Company Case Study on Addressing Sector Challenges and Driving Behavioural Change Campaigns

- 7WBS2012 Executive Career Development Assignment: Career Pathway & Readiness Post-MBA in Education Management

- CVE2322 Gantry Build Prototype Assignment: Sustainable Civil Engineering Model Using Recyclable Materials

- BMG706 Strategic Quality Change Assignment Report: Enhancing Operational Excellence at any Organization

- CVE2323 Structural Analysis Assignment: Matrix Method & STAAD.Pro Evaluation of Frame Systems

- BMK3015 Major Project Assignment: Customer-Centric Design Solutions Using Research & Project Management

- Wellbeing Assignment: University Students’ Perspectives for Improving Mental Health Support

- BCLO001 Business Statistics Assignment: Analysis of Exercise Duration Among Singaporean Students

- BM4364 Customer Experience Assignment: Evaluating CX Practices Through Employee Insights in the Service Industry