| University | Nanyang Technological University (NTU) |

| Subject | Accounting for Decision Making & Control |

Question 1

AV Solutions is a provider of computer and video projection equipment for use in auditoriums, lecture theatres and public spaces. In addition to equipment, they also provide on-site service and telephone support to customers (often involving remote access to equipm

ent)

Some years ago, an accountant determined the average cost of each call to the support line was about $100 (this included cost allocation of the phone system, CRM, consultant time etc). The average cost for each on-site service was about ten times this amount or $1,000

In 2019, the on-site service and support line involved costs of $1.15 million in respect of 4,000 calls to the helpline and 750 on-site callouts

(a) What was the profit/loss of the telephone support department and the on-site service department assuming each support call was charged to customers at $120, and on-site service was charged at $1,700 per callout?

Towards the end of 2019, the new accountant believed the old cost allocation system may no longer be serving the organisation well. She undertook a cost review process and determined the following information:

|

Cost type |

Amount |

Usage |

| CRM & computer system |

$205,000 |

75% in respect of telephone support, 25% in respect of on-site callouts |

| Travel & transportation |

$160,000 |

Entirely in respect of on-site callouts |

| Telephone expenses |

$50,000 |

60% telephone support, 40% on-site callouts |

| Salaries – Support team |

$555,000 |

33% telephone support; 67% on-site callouts |

| Salaries – Manager of a customer service & support |

$180,000 |

Time equally split between managing the call centre and on-site callout team |

(b) Determine (i) revised costs for each call to the telephone support line and each on-site callout and (ii) the profit of the telephone support department and the onsite service department

The new accountant did some further analysis of the costs allocated to on-site callouts. She determined these costs related to three activities:

- Scheduling and dispatch – about 10% of all costs, excluding travel & transportation

- Travel – 100% of travel & transportation costs

- Support – about 90% of all costs, excluding travel & transportation

She decided to allocate scheduling and dispatch costs evenly over each callout. Travel time was to be allocated based on distance, and in 2019 her team travelled a total of 18,000km going to and from client sites. Support costs were to be allocated based on hours spent on-site and a review of records showed 5,000 hours for 2019

(c) Determine activity-based costs for each of the three activities

A review of callouts showed great variation. For example, callout #207 involved total distance travelled of 42km and 18 hours on-site while callout #493 involved a travel distance of 6km with only two hours on site

(d) Using activity-based costing, what was the cost of callout #207 and callout #493?

(e) What costing method should the business use – the original costing system (part a), the revised costing system (part b) or activity-based costing (part c)? Why?

(f) Do you recommend the business make any other changes? If so, what and why?

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

Question 2

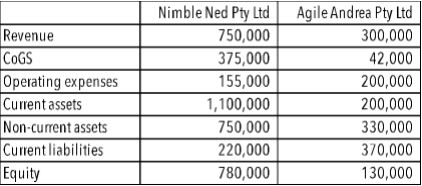

You have been asked to analyse the performance of two businesses and have obtained the following information:

You have noted each business pays interest at a rate of 10% on non-current liabilities

(a) For each business, perform DuPont Analysis

(b) Comment on performance. Which business is performing better based on profitability, return on assets, return on equity? Explain

Question 3

The Nanyang Business School recently implemented a new pricing model for a new program comprising 16 individual courses. Rather than pay a fixed fee of SGD6,000 per course, students would pay an upfront fee of SGD2,000 per course (collected in advance) and a performance-based fee based on end-of-course feedback (collected after a course has been taught)

End-of-course feedback scores (calculated based on feedback submitted by students) could be as low as zero (lowest possible score for a terrible course) or as high as 10 (highest possible score for an excellent course). The performance-based fee was calculated based on the feedback score multiplied by SGD550. For example, a course receiving a final feedback score of 7.5 would result in a performance fee of SGD4,125 paid by each student

This new model was introduced on the assumption students would be prepared to pay more for a really good learning experience, but would save money where a course was not up to Nanyang’s high standards

For 2020, Nanyang planned on offering the program to 50 students who would each complete 16 courses. For planning purposes, Nanyang expected each course would receive a feedback score of 7

(a) Prepare a revenue budget for 2020

By the end of 2020, the following actual data was collected:

- Number of students 46

- Number of courses 17

- Average feedback score 7.9

- An upfront fee charged $1,900 (discounted at last minute due to competition)

(b) Prepare a reconciliation of budgeted revenue to actual revenue

Four teams were involved in this new program:

- Marketing and admissions team – responsible for recruiting students

- Program admin – responsible for course structure, number of courses, scheduling and pricing

- Faculty – responsible for course delivery

(c) Comment on the performance of each team

Question 4

(a) Explain the relationship between strategy, performance measures and

incentives. What can happen if these three are not well aligned?

Consider Singapore Airlines (full-service carrier with the economy, premium economy, business and first classes) and Scoot (low-cost carrier offering only economy and a very basic business class)

(b) Provide two or three examples of where you would expect differences in the balanced scorecard for Singapore Airlines as compared to Scoot, and where you would expect similarities

Question 5

EMCC is a childcare provider in East Melbourne. They charge $125 per day per child and have a capacity of 50 children spread across three rooms – babies, toddlers and kinder

The variable costs are approximately $29 per day per child and cover meals, cost of materials and activities. Fixed cost (mostly staff and rental expense) amount to $20,000 per week and the centre operates Monday to Friday only

(a) What is the breakeven number of children

(b) If the centre is full, what is the daily and weekly profit?

(c) What price would be required to achieve a profit of $5,000 per week with 90% capacity utilisation?

(d) [CHALLENGE QUESTION #1] Assume a tax rate of 30%. What price would be required to achieve a profit of $6,000 per week with an enrolment of 48 students per day

EMCC is considering opening a second centre with a fixed cost of $3,000 per day. The following prices and costs have been determined for the second centre:

- Babies room: Fee $150 per child per day; variable cost $40 per child per day, max of 12 children

- Toddlers room: Fee $130 per child per day; variable cost $35 per child per day, max of 18 children

- Kinder room: Fee $105 per child per day; variable cost $20 per child per day, max of 30 children

(e) [CHALLENGE QUESTION #2] How much does EMCC make on the “average child”, across all rooms? Calculate break-even by room in terms of number of students and revenue. What is the new centre’s revenue at the break-even point

We help management students of Nanyang Technological University (NTU) in finishing accounting for decision making & control assignments for achieving good marks. We serve in every corner of the world. Our top Singaporean writers help in Nanyang Business School assignments at an affordable price.

Looking for Plagiarism free Answers for your college/ university Assignments.

- EGH222 Healthcare Analytics Assignment 2: Predictive Model for Sick Days Based on Employee Demographics and Lifestyle Data

- Sustainability Strategy Assignment: Selected Company Case Study on Addressing Sector Challenges and Driving Behavioural Change Campaigns

- 7WBS2012 Executive Career Development Assignment: Career Pathway & Readiness Post-MBA in Education Management

- CVE2322 Gantry Build Prototype Assignment: Sustainable Civil Engineering Model Using Recyclable Materials

- BMG706 Strategic Quality Change Assignment Report: Enhancing Operational Excellence at any Organization

- CVE2323 Structural Analysis Assignment: Matrix Method & STAAD.Pro Evaluation of Frame Systems

- BMK3015 Major Project Assignment: Customer-Centric Design Solutions Using Research & Project Management

- Wellbeing Assignment: University Students’ Perspectives for Improving Mental Health Support

- BCLO001 Business Statistics Assignment: Analysis of Exercise Duration Among Singaporean Students

- BM4364 Customer Experience Assignment: Evaluating CX Practices Through Employee Insights in the Service Industry