Question 1

Old Signboard Bak Kut Teh (hereafter, OSB) commenced operations as a small family business selling Teochew style pork rib soup in a coffee shop in the Central Business District some thirty years ago. Over the years, OSB has garnered a strong clientele with its distinctive and flavourfully spiced soup as well as the dark sauce that complements the pork ribs perfectly. With the growing clientele, the business has since shifted to a bigger location in a shop house and air-conditioned.

As the company only operates through its one and only shop house, there is always a long queue during peak hours. As a result, takeaway sales have been increasing over the years. Increasingly, eat-in customers have also asked to take away their two most popular products – Bak Kut Teh spice and the dark sauce. Both of these products are currently packaged and sold in small jars, and in respect of the Bak Kut Teh spice, they are prepared fresh.

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

To leverage upon its strong reputation, OSB has in recent years also started retailing through the local supermarket chains like NTUC Fairprice. Both the Bak Kut Teh fresh spice and black sauce are sold in a standard sized vacuum-capped jars. The fresh spice’s shelf life is three days while the black sauce is six months.

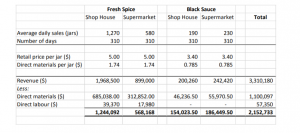

According to the latest sales analysis for 20×8, about 31 percent of OSB’s fresh spice and 55 percent of its black sauce were sold through supermarkets. The company retails these two products at the same price as those sold at its shop house. The accounting department of OSB has provided the following actual sales and costing details for 20×8.

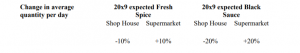

As a small family-run business, OSB’s budgeting process is very elementary. The business merely used the previous year’s actual results as its master budget/target for the new financial year. About six months into operations in 20×9, OSB expected its revenue for 20×9 to differ from 20×8 in the following proportion:

The family’s secret recipe of the Bak Kut Teh spice is tightly guarded. A close family member normally does the initial mixing of the fresh spice in a closed room. There are two other workers who will then grind the fresh ingredients such as garlic, and mix with the spices before packaging them into small jars. These two workers also help with the cleaning, cutting, and general preparation of the other ingredients like the pork ribs, vegetables and fried dough fritters. These costs are directly traceable labour costs to the Bak Kut Teh fresh spice.

Another five employees, who serve customers and work in the kitchen, receive fixed salaries. The black sauce is prepared by one of these employees, whose time cannot be directly traced to the product, as he performs other kitchen duties. Another kitchen hand, who assists in various work, including cleaning, operates a semi-automated vacuum packing machine for the Bak Kut Teh fresh spice and the black sauce. There is no systematic method to record the actual time associated with preparation and packaging of these two products. All employees working at the shop house share an eight percent bonus on the shop house revenue.

Starting from January 20×9, the owners’ elder son Alex, who recently graduated from SUSS, joined the company as a full-time employee on a salary of $60,000 per annum. Alex is also entitled to share the eight percent revenue bonus.

The company has aside a budget for sales and marketing activities – three percent of its shop house revenue. For sales through the local supermarkets, shelf space and promotion charges of 10 percent of the retail price for Bak Kut Teh fresh spice and 12 percent of the retail price for black sauce apply.

The 20×8 audited financial statements reflected administrative and other expenses totalling $1,339,000. This amount consisted of the two owners’ salaries and other fixed expenses, such as depreciation expenses.

Required:

The various costs identified for 20×9 should be differentiated into variable and fixed costs for the income statement under variable costing by assuming:

Finance cost being 3.25 percent on the average loan amount of $400,000; and

Fixed costs incurred in 20×9 remained the same in 20×8.

(a) Prepare and present an estimated variable costing income statement by sales channel and product line. (24 marks)

(b) With the help of sketching graphs (not detailed plotting), explain the usefulness of classifying costs into fixed and variable. (12 marks)

(c) Compute the expected operating leverage for 20×9 based on the revised sales targets and comment on its significance for decision purposes (show operating leverage to four decimal places). (12 marks)

(d) Perform a multiproduct breakeven analysis to identify the expected breakeven points (in sales dollars) for both products sold through each distribution channel in 20×9. (24 marks)

(e) Using the contribution margin computed in part (d), calculate the additional impact to total sales dollars for 20×9 as a result of the salary paid to Alex for his involvement in the business. Correspondingly, explain what is the impact to sales units for both products sold through each distribution channel in 20×9. (12 marks)

(f) Identify two (2) critical qualitative considerations to enable the management of OSB make better decisions when using Cost-Volume-Profit (CVP) analysis. (16 marks)

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

If your require assistance in accounting assignments in Singapore then SingaporeAssignmentHelp.com is the perfect place for all your requirements. We have a team of 24x7 online customer support experts that work passionately and deliver excellent my assignment writing help for the students.

Looking for Plagiarism free Answers for your college/ university Assignments.

- AVET104 Journey Through the Cell Assignment: A Molecular Adventure into Life’s Inner Workings

- Workplace Risk-Based Assessment 1: Evaluation of Hazards, Accidents, and Safety Compliance

- SRM Reflective Assignment 2: Applying Gibbs Model to Overcome Workplace Report Challenges

- ACLP M1P TAE Written Assignment: Skills Framework & Lesson Plan Design Using Gagne’s and Kolb’s Models

- EGH222 Healthcare Analytics Assignment 2: Predictive Model for Sick Days Based on Employee Demographics and Lifestyle Data

- Sustainability Strategy Assignment: Selected Company Case Study on Addressing Sector Challenges and Driving Behavioural Change Campaigns

- 7WBS2012 Executive Career Development Assignment: Career Pathway & Readiness Post-MBA in Education Management

- CVE2322 Gantry Build Prototype Assignment: Sustainable Civil Engineering Model Using Recyclable Materials

- BMG706 Strategic Quality Change Assignment Report: Enhancing Operational Excellence at any Organization

- CVE2323 Structural Analysis Assignment: Matrix Method & STAAD.Pro Evaluation of Frame Systems