INDIVIDUAL ASSESSMENT 1 (100 marks)

Question (100 marks)

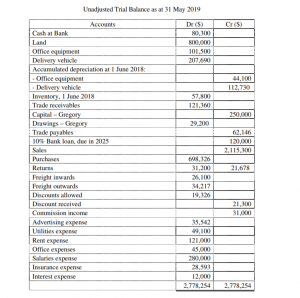

Gregory See started Agape Trading, a business dealing in computer accessories two years ago. The following trial balance has been extracted from his business records as at 31 May 2019:

The following additional information was made available before the year-end closing.

1. A physical count on 31 May 2019 revealed stocks on hand to be $128,000.

2. Commission income of $12,000 monthly has not been received nor recorded for February to May 2019.

3. Rent expense of $48,000 relates to payments made for period 1 March 2019 to 30 June 2019.

4. Salaries for the accounting year was paid up to 31 January 2019 only. Monthly salaries remained constant during the accounting year.

5. May 2019 sales included $24,300 paid by a customer for goods to be delivered in June 2019.

6. Cash discounts of $5,400 granted to credit customers have not been recorded in the accounts.

7. One of the credit customers who owed $5,900 settled the amount by cheque. This transaction was recorded as $9,500 on both the accounts.

8. Included in the utilities expense is a payment for Gregory’s home utilities of $3,900.

9. Payment of $7,500 for transport costs to deliver goods to a customer was recorded on the opposite sides of the accounts.

10. Gregory paid trade payables $14,250 with his personal cheque with a discount given to him at 5%. This transaction has not been recorded.

11. The amount of annual depreciation on fixed assets were as follows:

Office Equipment – $19,280

Delivery Vehicle – $31,770

Required:

(a) Prepare the necessary general journal entries to record transactions (2) to (11).

Narrations are not required.

(Hint: For some transactions, you will need to create new accounts which are not shown on the trial balance.) (40 marks)

(b) Prepare the following financial statements for Agape Trading:

(i) Statement of Comprehensive Income for the year ended 31 May 2019

(ii) Statement of Financial Position as at 31 May 2019 (60 marks)

Stuck with a lot of homework assignments and feeling stressed ? Take professional academic assistance & Get 100% Plagiarism free papers

Looking for someone to complete your accounting assignment writings in a short time? Then SingaporeAssignmentHelp.com is the best option among students. Our writers are best in completing your university papers. Take our SIM university assignment help for lowest prices possible.

Looking for Plagiarism free Answers for your college/ university Assignments.

- Wellbeing Assignment: University Students’ Perspectives for Improving Mental Health Support

- BCLO001 Business Statistics Assignment: Analysis of Exercise Duration Among Singaporean Students

- BM4364 Customer Experience Assignment: Evaluating CX Practices Through Employee Insights in the Service Industry

- GSFM7514 Accounting & Finance Assignment: SAC Services & MEMC Budgeting and CCID Investment Evaluation

- BM0973 BCRM Assignment: Genting Highlands Case Study for Crisis Response and AI-Supported Recommendations

- AC0779 Strategic Management Assignment Essay: Key Activities & Importance in Dynamic Healthcare Settings

- ComfortDelGro Organisational Design Assignment Report: ESG Alignment with UNGC Principles & Sustainability Strategy

- Bomb Threat Management Assignment: Incident Response Plan for High-Risk Facilities in Singapore

- Security Concept Plan Assignment Report: International School Campus Protection Strategy at Jurong East

- CM3065 Intelligent Signal Processing Assignment Report: Midterm Exercises on Audio Captcha, Steganography & Speech Recognition