| University | Institute of Singapore Chartered Account (ISCA) |

| Subject | Business Accounting |

Answer ALL questions below.

Question 1

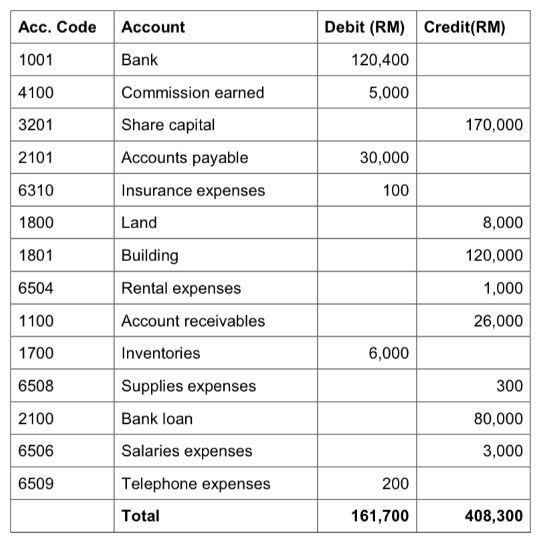

The following trial balance was prepared from the books of Cross Trading at its year-end, 31 May 2019. After the company’s bookkeeper left, the office staff was unable to balance the accounts or place them in their proper order. Individual account balances are correct, but debits were incorrectly recorded as credits and vice versa.

Required:

Prepare a trial balance showing the balances in the correct column. List the accounts in numerical order. Total the columns and ensure total debits equal total credits. Assume all accounts have normal balances.

Question 2

Provide two (2) reasons which could lead to the discrepancies between the balances shown in the bank statement and the cash book. Give examples.

Question 3

Elaborate the eight (8) steps in the accounting cycle.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Question 4

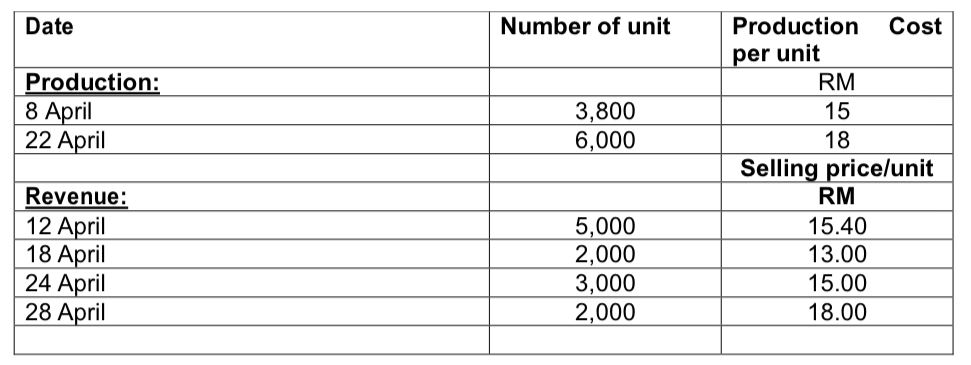

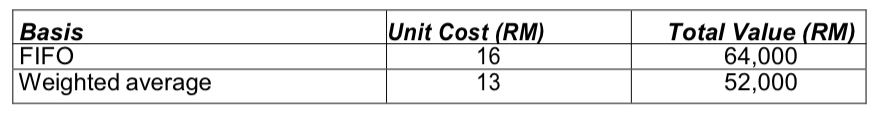

SY Furniture is a manufacturer of garden furniture. The company has consistently used weighted average cost in valuing inventory, but it is interesting to know the effect on its inventory valuation of using First In First Out method (FIFO).

At 31 March 2020, the company had an inventory of 4,000 standard plastic tables and has computed its value on each side of the two bases as:

During April 2020 the movements on the inventory of tables were as follows:

Required:-

(a) Using FIFO, compute the cost of closing inventory, sales and gross profit/loss as of 30 April 2020.

(b) Using the Weightage Average Cost method, compute the cost of closing inventory, sales, and gross profit/loss as of 30 April 2020. For (a) and (b), show relevant workings. In arriving at the total inventory values you should make calculations to two decimal places (where necessary) and deal with each inventory movement in date order.

(c) Explain the difference between a perpetual inventory system and a periodic system. Which one is more sophisticated?

Question 5

Ah Jie is the owner of Jie Kopitiam. At the end of each month, Ah Jie prepares a bank reconciliation statement for her business bank account. On 31 May 2019, her ledger balance was RM2,759 (credit) and her bank statement showed that she had funds of RM131 at the bank.

She has the following information:

(i) Jie has arranged for RM2,500 to be transferred from her personal bank account into the business bank account. The bank made the transfer on 30 May, but Jie has not made an entry for it in her records.

(ii) On 21 May, Jie withdrew RM100 cash which she did not record.

(iii) Cheque number 202003, which Jie issued to a supplier, appears on the bank statement as RM650. Jie incorrectly recorded the cheque as RM560.

(iv) The bank debited Jie’s account with charges of RM129 during May. Jie has not recorded these charges.

(v) On 31 May, Jie lodged RM457. On the bank statement, this amount is dated 3 June 2019.

(vi) Jie was advised by the bank that she earned RM52 interest for the period in May that her account was in credit. Jie recorded this in May, but the bank did not credit her account until June 2019.

(vii) Three of the cheques issued in May, with a total value of RM942, were not debited on the bank statement until after 31 May.

(viii) A cheque for RM276, issued to a supplier, was canceled but Jie has not recorded the cancellation of the cheque.

Required:

(a) Show the bank account in Jie’s general ledger, including any adjusting entries required due to the information given in points (i) to (viii). Note: You MUST present your answer in a format that clearly indicates whether each entry is a debit or a credit.

(b) Prepare a reconciliation of the bank statement balance to the corrected balance on the bank account in Jie’s general ledger.

(c) Indicate how the bank balance will be reported in Jie’s final accounts and the value to be reported.

Question 6

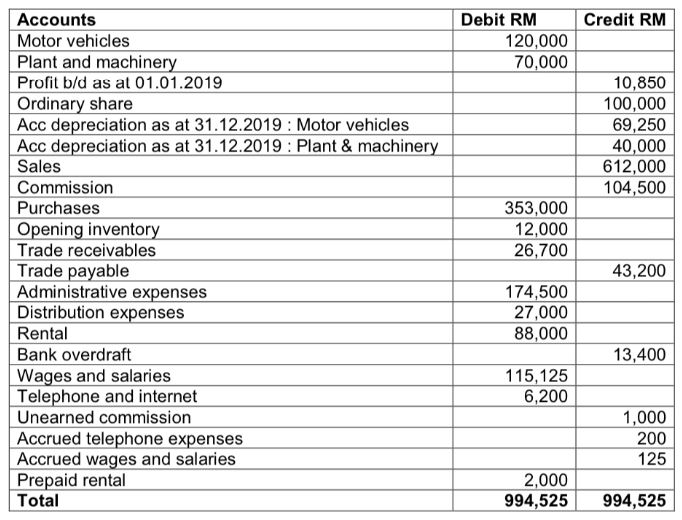

Below is the trial balance of Happy Meals Caterer as of 31 December 2019.

Additional information:

The closing inventory for the Year 2019 was RM40,000.

Required:

(a) Prepare the Statement of Comprehensive Income as of 31 December 2019 for Happy Meals Caterer.

(b) Prepare the Statement of Financial Position as at 31 December 2019 for Happy Meals Caterer.

If you are looking for a professional business accounting assignment help to get top-notch grades at ISCA, then hire an online assignment writer of Singapore Assignment Help. You can be assured that the assignment you will be getting will be fully authentic and match with the guidelines of the respective college, university, or institute.

Looking for Plagiarism free Answers for your college/ university Assignments.

- 7WBS2012 Executive Career Development Assignment: Career Pathway & Readiness Post-MBA in Education Management

- CVE2322 Gantry Build Prototype Assignment: Sustainable Civil Engineering Model Using Recyclable Materials

- BMG706 Strategic Quality Change Assignment Report: Enhancing Operational Excellence at any Organization

- CVE2323 Structural Analysis Assignment: Matrix Method & STAAD.Pro Evaluation of Frame Systems

- BMK3015 Major Project Assignment: Customer-Centric Design Solutions Using Research & Project Management

- Wellbeing Assignment: University Students’ Perspectives for Improving Mental Health Support

- BCLO001 Business Statistics Assignment: Analysis of Exercise Duration Among Singaporean Students

- BM4364 Customer Experience Assignment: Evaluating CX Practices Through Employee Insights in the Service Industry

- GSFM7514 Accounting & Finance Assignment: SAC Services & MEMC Budgeting and CCID Investment Evaluation

- BM0973 BCRM Assignment: Genting Highlands Case Study for Crisis Response and AI-Supported Recommendations