| University | National University of Singapore (NUS) |

| Subject | Principle of Finance |

Assignment (Individual) – 20 Marks

This assignment is designed to assess students’ knowledge on Portfolio Theory (Topic 3). Students are expected to assess risk and return statistics for individual stocks and for portfolios.

Question – 20 Marks

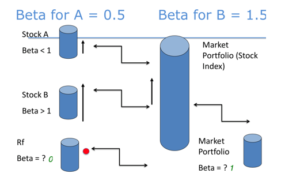

On Country X’s stock market, there are several stock indices. One of these indices is the Mini20 Index with an expected stock market return of 9% – RM, and a variance of 0.0225. The Treasury bill rate is 2%-RF.

Consider two firms in Country X, Abletronics and Huttle operating in the highly competitive car lithium battery industry. There are some reports of car fires and explosions in electric vehicles. Abletronics stock has a market capitalization of $100 million and an expected return of 15%.

Huttle is being led by a team of industry experts. The company’s trademark lithium batteries have the shortest charging times in the world. Huttle stock has a market capitalization of $50 million. The covariance (COMOVEMENT) of Huttle’s stock return with the market return was derived as 0.01125. The average historical return of Huttle stock was 5% and the beta value is 1.86.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Native Singapore Writers Team

- 100% Plagiarism-Free Essay

- Highest Satisfaction Rate

- Free Revision

- On-Time Delivery

Required:

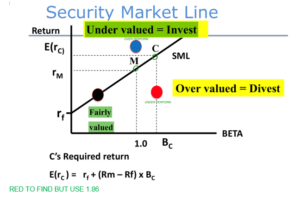

a. Assess if Huttle has under-performed or outperformed the CAPM.

If so, calculate the extent of under-performance or outperformance in percentage returns (5%) – EITHER. RED OR BLUE DOT. Critique the use of the CAPM to derive the required return (RF, RM, BETA) of Huttle stock. Provide at least 3 critiques – GO INTERNET DO RESEARCH ON 3 JOURNAL ARTICLES, ONE OF EACH CRITIQUE. TGT WITH IN-TEXT CITATION AND END OF TEXT CITATION (REF LIST).

b. Firm Zing operates in the same industry as firm Abletronics. The two companies’ business risk are similar. However, in addition to its operating assets, Zing holds $50 million in risk-free treasury bills. Zing’s market capitalization is $300 million.

Compute Zing’s beta value – 1.86.

c. Zing sold its treasury bills (50MIL) and used the cash proceeds to purchase all of Huttle’s stock (50MIL). Assume Huttle stock is bought for its market value.

i. Compute the value of the conglomerate Zing-Huttle.

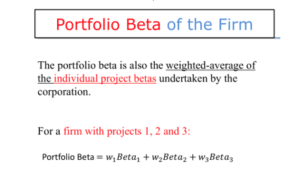

ii. Compute the beta of the conglomerate Zing-Huttle – ZING OP ASSET = 1 ASSET, ZING HUTTLE OP ASSET = 1 ASSET, USE PORTFOLIO BETA EQN.

iii. Compare the risk of Zing and Zing-Huttle and explain any differences – COMPARE RISK LEVEL BEFORE AND AFTER AND EXPLAIN/DESCRIBE THE DIFFERENCES.

Note:

- To provide all relevant formulae and to show all workings with accompanying explanations.

- Word count requirement: Maximum 1,000 (actual word count to be stated on the cover page of the assignment). – 780-800 NORMAL – COVER PAGE, REF LIST, APPENDIX IS NOT COUNTED.

- Minimum number of references: 3 – PART A.

Buy Custom Answer of This Assessment & Raise Your Grades

Looking for Plagiarism free Answers for your college/ university Assignments.

- EE4524 Design of Clean Energy System Assignment Questions 2026 | NTU

- PSY107 Introduction to Psychology 1 Tutor-Marked Assignment 02 2026

- BPM213 Procurement Management Tutor-Marked Assignment One 2026 | SUSS

- ICT330 Database Management Systems Tutor-Marked Assignment Questions 2026

- 7WBS2009 Financial Management and Analysis Assignment Brief 2026 | SUSS

- 5010MKT Marketing Management Assignment Brief 2026 | Coventry University

- FILM1000 Introduction to Film Studies Assignment Brief 2026 | NTU

- CET206 Full Stack Web Application Development Tutar Marked Assignment Questions 2026 | SUSS

- 7WBS2011 Strategic Management Research Assignment Brief 2026 | PSB Academy

- HBC101 Understanding Contemporary Society: The Social and Behavioural Sciences TMA 01 2026 | SUSS