| University | University of London (UOL) |

| Subject | Accounting and Managerial Finance |

Question 1

Using the following link, https://www.asosplc.com/investors/latest-results, download ASOS Plc’s annual reports for the past three (most recent) years and provide critical analysis of the financial health of the company. The annual reports are in a consolidated format, and relevant financial statements can be found under the latest results (results archive) section. Do not forget to review the notes to the financial statements.

Required:

- Write a brief introduction of the company and the current midterm (3-5 years) outlook. Maximum of 300 words.

- ASOS Plc’s key financial ratios (for all 3 years) need to be calculated and included in the report in table or chart format. Key ratios for a key competitor or the industry should also be included in the analysis.

- Interpret and assess ASOS Plc’s performance in the most recent year (the newest annual report) in comparison to the previous two years, justifying the significant differences.

- Critically assess the company’s approach to working capital management.

Question 2

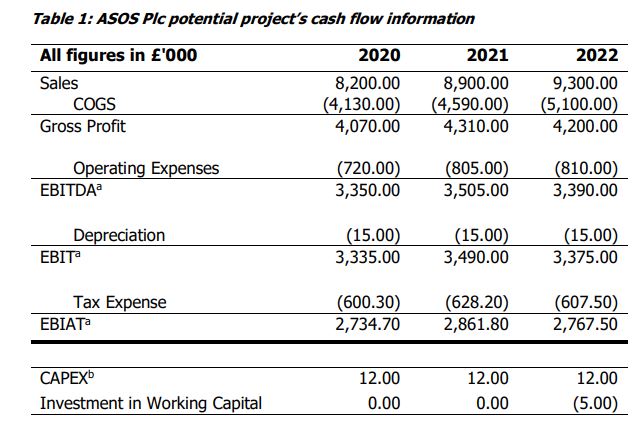

ASOS Plc is currently evaluating a new project that will expand its current ‘living and gifts’ line to include not only home accessories but also to produce and sell modern home furniture. The project will require an initial outlay of £6,000,000 on production machinery and other costs. The project is expected to have a three-year life span, and the estimated cash flows associated with the project are presented in the below table:

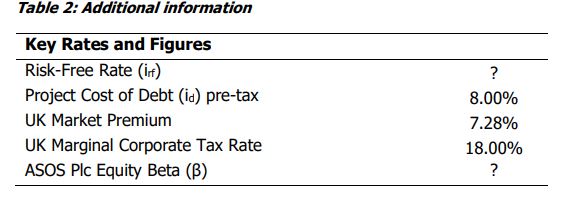

The project has a debt capacity of 30% of the cost of the project, with an annual interest charge of 8%. The company currently has £3,000,000 of retained earnings available for this project, and the remainder would be potentially financed with the rights issues. The rights issue incurs additional costs of 2% of the amount raised, and the debt issuance is a bit cheaper, costing 1%, where both issue costs are tax-deductible.

You will need to research the other values needed to complete Table 2 above.

Required:

The company believes it will be a successful project and will help to distinguish them from competitors. However, they would like you to evaluate the project using different methods and recommend a proposal to the investment committee in order for them to approve it:

- ASOS Plc is considering financing the project with 30% debt. Using the Adjusted Present Value (APV), value the project. (Assume the same level of debt is held until the end of the project. Do not consider the repayment of the debt principal in any of the valuations.) Hint: calculate the free cash flow of the project and use CAPM to compute the discount rate.

- How would your evaluation change if the machinery manufacturer offered you purchase of the production machine with a three-year, £4,000,000, 8% loan (subject to 1% issue costs)? Assume the remainder of the initial outlay is equity. Discuss the benefits and disadvantages of the APV method. Hint: use APV again, but this time do not forget to take into account the benefits but also the additional costs of this option.

- Using NPV, evaluate the project using the Weighted Average Cost of Capital (WACC), assuming a 50% debt. Hint: assume the Beta obtained is Equity Beta

- Contrast the methods and scenarios, and give a final recommendation to the investment committee. Make sure you critically evaluate the methods and discuss other risk factors that were not included in the analysis.

You are most welcome to Singapore Assignment Help. We have a team of dedicated and highly experienced homework helpers who work 24/7 hours to give London university and Singapore university students the best assistance in accounting and managerial finance assignments. So avail our quality accounting assignment help now with some amazing discount offer.

Looking for Plagiarism free Answers for your college/ university Assignments.

- EGH222 Healthcare Analytics Assignment 2: Predictive Model for Sick Days Based on Employee Demographics and Lifestyle Data

- Sustainability Strategy Assignment: Selected Company Case Study on Addressing Sector Challenges and Driving Behavioural Change Campaigns

- 7WBS2012 Executive Career Development Assignment: Career Pathway & Readiness Post-MBA in Education Management

- CVE2322 Gantry Build Prototype Assignment: Sustainable Civil Engineering Model Using Recyclable Materials

- BMG706 Strategic Quality Change Assignment Report: Enhancing Operational Excellence at any Organization

- CVE2323 Structural Analysis Assignment: Matrix Method & STAAD.Pro Evaluation of Frame Systems

- BMK3015 Major Project Assignment: Customer-Centric Design Solutions Using Research & Project Management

- Wellbeing Assignment: University Students’ Perspectives for Improving Mental Health Support

- BCLO001 Business Statistics Assignment: Analysis of Exercise Duration Among Singaporean Students

- BM4364 Customer Experience Assignment: Evaluating CX Practices Through Employee Insights in the Service Industry